According to a press release by the Public Relations department of the National Development Fund, Mehdi Ghazanfari presented a comprehensive report on the fund's performance in the past year during the latest session of the Board of Trustees. The session, held on Monday, June 19, 2023, was chaired by President Raisi, with the participation of other board members.

During the session, the CEO of the National Development Fund discussed the process of collecting receivables through asset ownership. He highlighted that the fund has acquired 33% of Sina Bank's shares, amounting to $100 million from foreign currency receivables of affiliated companies under the Mostazafan Foundation. Additionally, $12.5 million from assets related to Tejarat Bank, through the transfer of overdue foreign currency receivables, have also been obtained by the National Development Fund.

Furthermore, Ghazanfari mentioned the ongoing negotiations with Mellat, Sepah, and Sanat-o-Madan banks to acquire shares of their subsidiary companies. He also revealed that an agreement has been signed with the Ministry of Oil to acquire certain physical assets, although its operationalization is pending.

Threefold Growth in Fund Collection, Reaching $3.3 Billion

According to Ghazanfari, the fund collection of the National Development Fund has experienced a remarkable threefold increase, reaching an impressive $3.3 billion. Mr. Ghazanfari, in his speech, highlighted that over the past two years, approximately $3.3 billion in fund claims have been successfully collected in cash. He further elaborated on the specific figures, stating that during the second half of 2021, nearly $1.3 billion was collected. In 2022, around $1.7 billion was amassed, and in the spring of 2023, an additional sum of $0.3 billion in foreign currency claims was collected, signifying a notable threefold growth compared to the previous governments.

Mr. Ghazanfari further underscored the importance of addressing outstanding foreign currency claims, which currently stand at a substantial $13.2 billion. Out of this total, $10.6 billion has been allocated to 56 projects secured by the National Iranian Oil Company, while $1.1 billion has been directed towards 32 power plant projects, and $1.5 billion to 82 industrial initiatives.

Threefold Growth in Fund Collection, Reaching $3.3 Billion

According to Ghazanfari, the fund collection of the National Development Fund has experienced a remarkable threefold increase, reaching an impressive $3.3 billion.Mr. Ghazanfari, in his speech, highlighted that over the past two years, approximately $3.3 billion in fund claims have been successfully collected in cash. He further elaborated on the specific figures, stating that during the second half of 2021, nearly $1.3 billion was collected. In 2022, around $1.7 billion was amassed, and in the spring of 2023, an additional sum of $0.3 billion in foreign currency claims was collected, signifying a notable threefold growth compared to the previous governments.

Mr. Ghazanfari further underscored the importance of addressing outstanding foreign currency claims, which currently stand at a substantial $13.2 billion. Out of this total, $10.6 billion has been allocated to 56 projects secured by the National Iranian Oil Company, while $1.1 billion has been directed towards 32 power plant projects, and $1.5 billion to 82 industrial initiatives.

Fund participation should not lead to ownership

Regarding the investment policies of the National Development Fund, the CEO emphasized the fund's primary focus on projects with investment volumes exceeding $100 million. For projects falling below this threshold, the fund typically extends facilities in the form of financial support. However, it is crucial to ensure that fund participation does not result in ownership.

Energy accounts for 65% and mining for 25% of the fund's investment portfolio

Ghazanfari referred to the Investment Portfolio Statement (IPS), which has been approved for the first time in the fund's history and is considered a high-level investment document.

The fund's investment portfolio reflects a strategic distribution, with energy-related sectors such as oil, gas, and petrochemicals accounting for a substantial 65%. Mining and mineral industries represent 25% of the portfolio, while the remaining 10% is allocated to diverse sectors, including power plants, water supply and transfer for industrial purposes, biotechnology, healthcare, food security, financial markets (capital market and money market), and export-oriented industries.

Furthermore, the fund will pursue asset ownership in different sectors as necessary to facilitate the collection of fund claims, adhering to the guidelines outlined in the investment statement.

Inclusion of 2 New Financial Instruments in the National Development Fund

Ghazanfari expressed that the main financial means utilized by the fund over the past 10 years have primarily been in the form of facilitation payments. With the implementation of new resolutions by the fund's board of trustees, two alternative methods have been proposed, namely "participation" through private or public partnerships, and the establishment of "funds" such as Private Equity (P.E.) or Foreign Exchange Project Funds.

Enhancing Diversity in the National Development Fund's Financial Instruments

Highlighting these three primary types of instruments, it is stated that they can be used individually or in combination. As a result, the fund has a range of composite financial instruments at its disposal. Ghazanfari explained that in order to bring diversity to this sector and move beyond the fund's role solely as a provider of loan facilities, new composite financial instruments have been defined within the fund. These instruments can be broadly categorized as "decision" or "option" instruments. In the first approach, decisions regarding the fund's interests are made at the time of participation (through binding contracts or definitive agreements), along with the provision of loans. The fund also obtains equity participation, shares in profits, product involvement, or financial benefits. In the second model (the option), the loan is initially disbursed, and decisions regarding the fund's equity ownership, withdrawal rights, or participation are made in the future based on project progress. Essentially, the option contract is convertible. Both of these approaches represent new investment strategies for the fund. While the fund's role in projects will differ significantly, it effectively prevents it from being solely a lender.

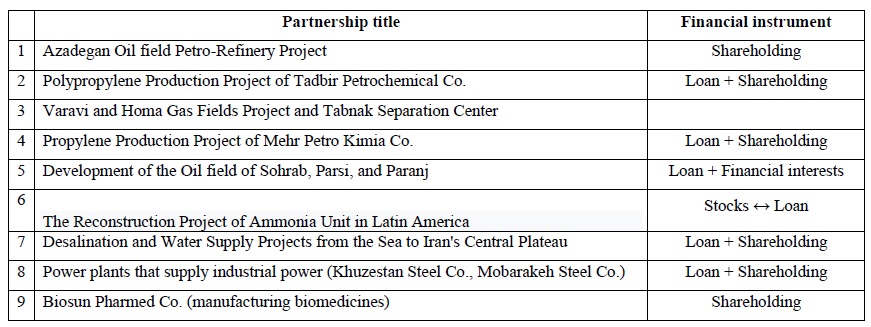

Furthermore, Ghazanfari presented 9 examples of new operational decisions made by the National Development Fund in the investment sector:

Ghazanfari elaborated: This type of equity ownership is sometimes convertible. As previously mentioned, the fund's equity stake can be in the form of financial benefits, such as profit-sharing or product involvement. Additionally, the availability of facilities as an option varies, where financing may be obtained through deposits, issuing securities, or attracting domestic or foreign capital.

Continuing the session, several members of the board of trustees emphasized the active participation of the National Development Fund in investment activities. They emphasized that the current challenges related to currency shortages and investment resources should not hinder the fund's progress. It was suggested that the fund's charter, regulations, and procedures be amended to enable it to quickly contribute to major national investment projects and serve as a catalyst for attracting foreign investments.

In addition to the proposals put forth for the National Development Fund, including budget allocation for the fund's headquarters and the exclusion of all government withdrawals and authorities from the fund (unless specifically provided otherwise), the use of oil vouchers by the fund was approved.

Ultimately, two significant responsibilities were assigned to the President and the CEO of the fund. Firstly, they were tasked with conducting a comprehensive assessment of the fund's 10-year performance and providing recommendations for amending the charter, regulations, and bylaws. The second responsibility, which will have an impact on the fund's future over the next 5 years, is the interaction between the National Development Fund and the parliament in collaborating with honorable representatives regarding certain reforms in the provisions related to the fund.